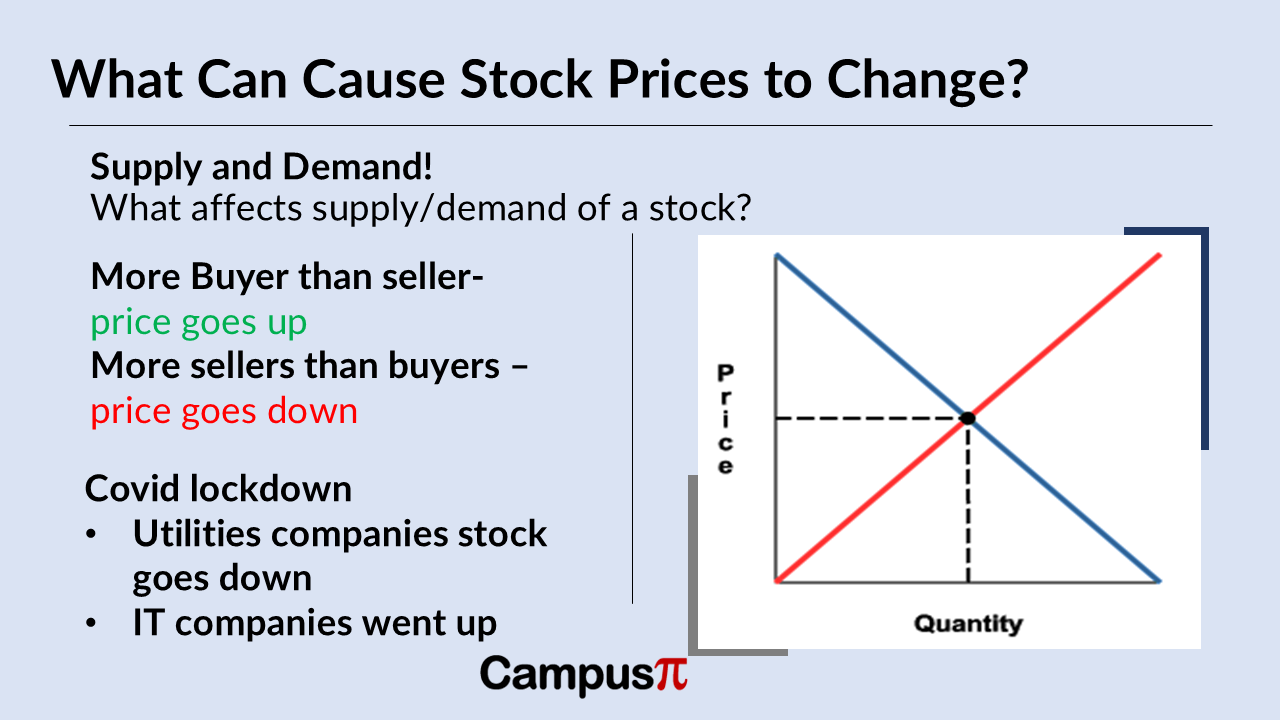

The basic principle of how stock prices move is based on market demand and supply. When there are more buyers than sellers for a stock, demand increases, pushing the price up. Conversely, when there are more sellers than buyers, supply outweighs demand, causing the price to fall. This simple yet powerful concept underlies all price movements in the stock market.

Key Summary

- Stock prices fluctuate due to a variety of factors, all rooted in supply and demand. One of the main drivers is company performance—strong earnings reports, new product launches, or expansion plans often boost investor confidence and drive prices up.

- Poor results or negative news can push prices down. Broader economic indicators also play a role; inflation, interest rates, and unemployment data can affect investor sentiment and market trends.

- Market speculation and investor psychology are powerful forces—fear and greed can cause overreactions in either direction. Global factors like geopolitical tensions, pandemics, or commodity price shifts (like oil) can ripple through markets, impacting stock prices.

The Role of Supply and Demand in Stock Prices

At the heart of the stock market lies the simple yet powerful law of supply and demand. This principle determines the price of almost everything in a free-market economy — including stocks.

- When demand exceeds supply — meaning there are more buyers than sellers — the price goes up.

- When supply exceeds demand — meaning there are more sellers than buyers — the price goes down.

This concept is beautifully illustrated in the classic supply and demand graph. The intersection of the supply and demand curves marks the equilibrium price — the point at which the number of shares buyers want to purchase equals the number of shares sellers want to sell.

Why Do Stock Prices Fluctuate?

Stock prices change in response to a variety of factors, including:

- Company Performance

- Strong earnings reports, new product launches, and successful business strategies attract more buyers.

- Poor financial results or negative news lead to increased selling pressure.

- Economic Events

- Interest rate changes, inflation data, GDP growth, and employment figures all affect investor sentiment.

- Positive economic indicators usually push stock prices up, while negative data can cause prices to fall.

- Global Crises and Natural Disasters

- Events like wars, natural disasters, and global pandemics (e.g., COVID-19) drastically shift investor behavior.

- These events often result in significant reallocation of capital between different sectors.

- Industry Trends

- If an entire industry is booming (e.g., tech during the early 2020s), companies within that sector often see their stock prices increase, even if individual performance varies.

- Market Sentiment and Speculation

- Sometimes, perception alone drives prices. If investors believe a stock is going to do well, their collective buying can push the price up — regardless of the company’s actual performance.

Case Study: COVID-19 and Stock Market Shifts

One of the most impactful real-world examples of stock price change due to external factors was during the COVID-19 pandemic.

- Utilities Sector:

Many utility companies saw a drop in demand as businesses shut down and people used less commercial energy. As a result, the stock prices of utility companies declined. - Technology Sector (IT):

In contrast, tech companies thrived during lockdowns. Remote work tools, video conferencing apps, and cloud-based services became essential. Consequently, IT companies saw a surge in demand, and their stock prices rose significantly.

This divergence highlights how different sectors respond to macroeconomic events and how investor demand shifts based on perceived future value.

Using Supply and Demand to Make Smart Investment Choices

By understanding the dynamics of supply and demand, investors can make more informed decisions. While it’s impossible to predict the stock market with certainty, observing the balance between buyers and sellers, as well as tracking sentiment and news, can provide valuable insight.

Here are some practical tips:

- Watch trading volumes: A price movement accompanied by high volume suggests strong conviction.

- Stay informed: Follow economic data releases, earnings reports, and global news.

- Diversify: Spread investments across sectors to manage risk during unpredictable events.

- Use technical analysis: Price charts often reveal patterns related to supply and demand behavior.